Massachusetts residents are being warned to stay vigilant against a surge in IRS rebate scam texts targeting taxpayers across the state. Authorities report an alarming rise in fraudulent messages impersonating the IRS, aiming to steal personal information and financial details under the guise of offering tax refunds or recovery rebate credits. Cybersecurity experts highlight that such phishing attempts have increased sharply this tax season, prompting officials to urge the public to verify all communications claiming to be from the IRS before responding or providing sensitive data. The IRS continues to caution that it will never initiate contact via text and stresses the importance of awareness to avoid falling victim to these deceptive schemes.[[1]] [[2]] [[3]]

Table of Contents

- Massachusetts Authorities Warn Public About Surge in IRS Rebate Scam Texts

- How Scam Texts Target Residents With Fake IRS Rebate Claims

- Key Indicators to Identify and Avoid IRS Rebate Scam Messages

- Steps Massachusetts Residents Should Take if They Receive Suspicious IRS Texts

- Closing Remarks

Massachusetts Authorities Warn Public About Surge in IRS Rebate Scam Texts

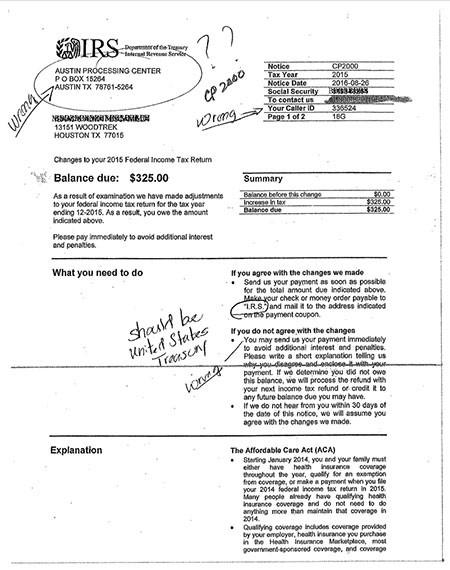

Massachusetts authorities are urging residents to remain vigilant amid a sharp increase in fraudulent text messages impersonating the IRS regarding supposed rebate payments. These scam texts, which have surged in recent weeks, claim that recipients are eligible for IRS rebate refunds but must act quickly by clicking suspicious links or providing sensitive personal information. Officials emphasize that the IRS does not initiate contact about rebates via text messages and warn that engaging with these scams could lead to identity theft or financial loss.

Residents are advised to follow these key precautions to protect themselves from falling victim to the scam:

- Ignore unsolicited texts claiming to be from the IRS requesting personal or financial information.

- Avoid clicking on any links or downloading attachments from unknown or suspicious numbers.

- Verify any IRS-related dialog directly by contacting official IRS channels or visiting the official website.

- Report any scam texts to the Massachusetts Attorney General’s office or the Federal Trade Commission.

How Scam Texts Target Residents With Fake IRS Rebate Claims

Residents across Massachusetts have reported a surge in scam text messages falsely claiming that the IRS is issuing rebate payments. These texts typically urge recipients to click on a link or provide sensitive information to “verify” their eligibility or claim their supposed rebate. However, these communications are designed to harvest personal data or redirect users to fraudulent websites, putting individuals at risk of identity theft and financial loss. The IRS has emphasized that it never initiates contact via text messages about rebates or tax refunds, alerting taxpayers to remain vigilant.

Victims have noted several hallmark signs of these scam texts, including:

- Unsolicited messages claiming urgent rebate action or threatening tax-related consequences

- Links directing recipients to unofficial or suspicious websites requesting Social Security numbers or bank details

- Poor grammar and spelling errors inconsistent with official IRS communications

Experts advise Massachusetts residents to avoid clicking any links, delete suspicious texts promptly, and report the incidents to the IRS and local authorities. This vigilance is critical in combating the growing prevalence of IRS rebate scam texts during the current tax season.[1]

Key Indicators to Identify and Avoid IRS Rebate Scam Messages

Watch for unsolicited texts claiming to offer IRS rebates or stimulus payments. Legitimate IRS communications will never request personal information like Social Security numbers, bank details, or passwords via text. Be wary of messages that pressure you to act quickly or provide sensitive data. Common red flags include:

- Unexpected links directing you to unofficial websites

- Requests for immediate payment or “processing fees” to release funds

- Poor grammar, spelling errors, or generic greetings rather than your name

- Phone numbers that don’t match official IRS contacts

To safeguard yourself, always verify independently before responding. The IRS does not send rebate or refund notifications through text messages.If you receive suspicious communications, do not click any links or share information. Rather, visit the official IRS website or contact their offices directly to confirm your status. Reporting scam texts to authorities helps protect others and enables law enforcement to track these fraudulent schemes.

Steps Massachusetts Residents Should Take if They Receive Suspicious IRS Texts

If you receive suspicious texts claiming to be from the IRS about rebates or refunds,do not respond or click on any links. These messages are frequently enough attempts to steal personal information or install malware. Rather, immediately report the message to the IRS by forwarding it to IRS phishing@irs.gov. Avoid providing any financial details, Social Security numbers, or other sensitive information. It’s crucial to remember that the IRS will never initiate contact via text to request payment or private data.

Massachusetts residents should also take these preventive measures to protect themselves and their data:

- Delete suspicious texts without clicking on links or calling numbers provided.

- Verify any claims by contacting the IRS directly using official phone numbers or through their website.

- Monitor financial accounts regularly for unusual activity and report any discrepancies immediately.

- Use antivirus software on devices and keep all software updated to defend against cyber threats.

Closing Remarks

Massachusetts residents are urged to remain vigilant and verify any communications purportedly from the IRS, especially those requesting personal or financial information via text messages.To avoid falling victim to these rebate scams,experts recommend contacting the IRS directly through official channels. For further assistance or to report suspicious activity, taxpayers can reach the IRS at their official helpline.Staying informed and cautious is essential to protecting oneself from these ongoing fraudulent schemes.