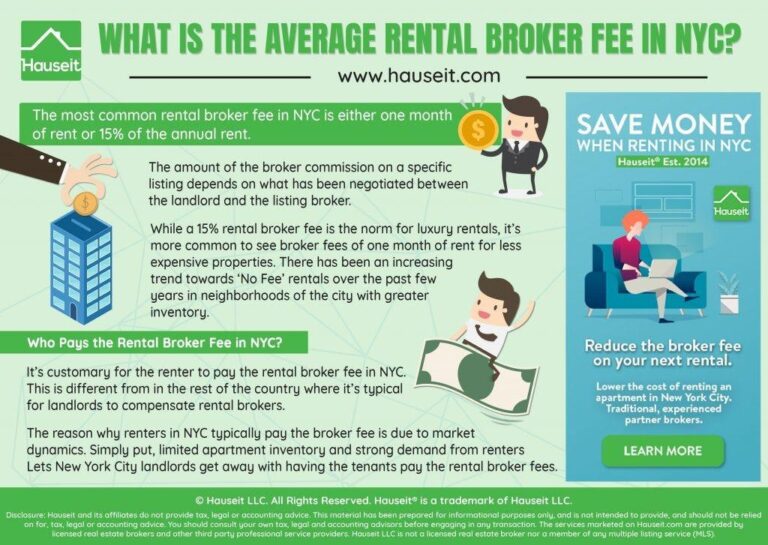

A important shift in New York City’s rental market is on the horizon as new legislation aimed at eliminating broker fees for renters has been proposed. The Fairness in Apartment Rentals Act (FARE Act),recently passed by the City Council,seeks to relieve tenants of the financial burden traditionally associated with broker fees,which have long been a barrier for many aspiring renters. Under the proposed law, landlords and their agents would be prohibited from charging broker fees to prospective tenants, marking a major development in tenant rights and rental affordability. This legislative change is expected to transform rental practices and bring greater clarity to the apartment leasing process across the city [3][1].

Table of Contents

- Legislation Aims to Relieve Financial Burden on Renters by Eliminating Broker Fees

- Impact Analysis of Proposed Broker Fee Ban on Rental Market Dynamics

- Landlord and Broker Responses to Potential Fee Elimination

- Policy Recommendations to Ensure Fair Implementation and Protect Tenant Interests

- In Conclusion

Legislation Aims to Relieve Financial Burden on Renters by Eliminating Broker Fees

In a significant move to ease the financial strain on renters, new legislation is being introduced to abolish broker fees, which often represent a considerable upfront cost in securing housing. Advocates argue that these fees, typically charged by rental brokers for matching tenants with apartments, have long acted as a barrier to affordable housing access, particularly in competitive rental markets. By eliminating these fees,the bill aims to remove hidden expenses that can disproportionately impact low- and middle-income renters,offering more clear and equitable housing opportunities.

The proposed legislation also emphasizes greater regulation and accountability within the rental marketplace.Key provisions include:

- Prohibiting rental brokers from charging fees to prospective tenants

- Encouraging landlords to absorb costs previously transferred to renters

- Increasing penalties for violations to protect consumers

- Promoting alternative tenant placement services that operate without fee-based models

If enacted, these measures could set a precedent for other jurisdictions grappling with rising housing costs, signaling a shift toward prioritizing renter protections over intermediary profits.

Impact Analysis of Proposed Broker Fee Ban on Rental Market Dynamics

The elimination of broker fees for renters is poised to reshape the rental market by altering the traditional cost distribution between tenants and landlords. Brokers,often paid by renters in many urban markets,provide critical matchmaking services between landlords and tenants,but their fees have been a significant financial barrier for many renters. Banning these fees may increase housing affordability, helping renters allocate funds toward other essential expenses. However, industry experts warn this shift could lead to brokers increasing fees charged to landlords or reducing services to compensate for lost income, potentially impacting overall market efficiency.

Key anticipated effects include:

- Increased accessibility for renters who previously faced prohibitive upfront costs.

- Potential rise in rents as landlords absorb broker costs or transfer them indirectly.

- Market adaptation where brokers might limit service scope or pivot to alternative revenue models.

- Possible reduction in tenant screening quality, influencing rental market risks.

As the rental sector adjusts, monitoring these dynamics will be crucial to ensure the legislation achieves its goal of supporting renters without unintended market disruptions.

Landlord and Broker Responses to Potential Fee Elimination

Landlords voiced mixed reactions to the proposed legislation, highlighting concerns about the potential financial ripple effects throughout the rental market. Many worry that eliminating broker fees-which are frequently enough paid upfront by renters-could lead to landlords compensating through increased rental prices or stricter lease terms. A few landlords argued that the fee structure currently helps regulate tenant demand and maintain fair access to housing, while others remain cautiously optimistic that the law could simplify renting and boost tenant satisfaction without drastically impacting market dynamics.

Simultaneously occurring, brokers expressed strong opposition, emphasizing the critical role their services play in connecting renters and landlords efficiently. They argue that removing broker fees threatens their business model and could reduce the availability of professional guidance for renters navigating complex leasing processes. Brokers suggest alternatives such as implementing a shared fee model or capping fees to maintain service quality while addressing affordability concerns.Key points raised by brokers include:

- Ensuring continued investment in property marketing and tenant screening.

- Preserving competitive market dynamics that benefit both landlords and tenants.

- Potential for increased informal or unregulated renting activities without professional intermediaries.

Policy Recommendations to Ensure Fair Implementation and Protect Tenant Interests

To ensure the proposed legislation fully benefits renters without unintended consequences, lawmakers must establish transparent guidelines for enforcement. This includes implementing regular audits of rental transactions to detect and penalize brokers who attempt to circumvent the fee ban through hidden charges or inflated rents. Additionally, clear definitions of what constitutes a broker fee should be codified to prevent ambiguous interpretations that could undermine tenant protections. Tenant advocacy groups should be empowered with resources to educate renters about their rights and mechanisms to report violations confidentially.

Moreover,policies should mandate straightforward rental agreements,free from convoluted clauses that shift financial burdens back onto renters. Implementing a standardized disclosure form for all parties involved can promote accountability and streamline the leasing process. Recommended measures include:

- Caps on refundable deposits and fees unrelated to broker services

- Mandatory training for brokers on ethical compliance and tenant rights

- Creation of independent tenant ombudsman offices to mediate disputes effectively

These steps will help cultivate a fairer rental market environment, protecting tenants from exploitative practices while preserving essential services provided by ethical brokers.

In Conclusion

As this legislation moves through the legislative process, its potential to reshape the rental market remains under close scrutiny. Advocates argue that eliminating broker fees could provide much-needed financial relief to renters, while opponents caution about possible impacts on the real estate industry. Stakeholders and lawmakers alike will be watching closely as debates continue, with the outcome poised to affect millions of renters across the country. Further updates will follow as this story develops.