Massachusetts has announced an increase in the minimum auto insurance liability coverage requirements, marking a meaningful shift in the state’s approach to driver protection and financial responsibility. This change aims to provide greater security for motorists and pedestrians by ensuring more extensive coverage in the event of accidents. The adjustment reflects ongoing efforts to adapt to rising costs and evolving road safety challenges within the Commonwealth. Drivers across Massachusetts will need to review their insurance policies in response to the new mandate,which is expected to impact premiums and coverage standards statewide.

Table of Contents

- Massachusetts Raises Minimum Auto Insurance Liability Requirements

- Impact on Drivers and Insurance Premiums Across the State

- Expert Analysis on Coverage Adequacy and Risk Management

- Tips for Massachusetts Drivers to Navigate the New Insurance Landscape

- To Conclude

Massachusetts Raises Minimum Auto Insurance Liability Requirements

Effective instantly,Massachusetts has implemented stricter minimum auto insurance liability requirements to better protect drivers and pedestrians statewide. The revised regulations mandate higher coverage limits for bodily injury and property damage,aiming to address rising accident-related costs and ensure greater financial responsibility. Insurers and policyholders must now adhere to these updated standards, which mark the most significant enhancement since the last adjustment in the early 2000s.

Key changes include:

- Increased minimum coverage amounts for bodily injury per person and per accident

- Higher property damage liability limits to cover escalating repair costs

- New requirements encouraging drivers to review and possibly upgrade their existing policies

Insurance providers in Massachusetts are updating their offerings accordingly, with some of the best companies like Travelers, Geico, and Amica already adapting to help drivers comply seamlessly with the new laws [[1]](https://www.nerdwallet.com/insurance/auto/best-car-insurance-massachusetts) [[2]](https://www.bankrate.com/insurance/car/massachusetts/).

Impact on Drivers and Insurance Premiums Across the State

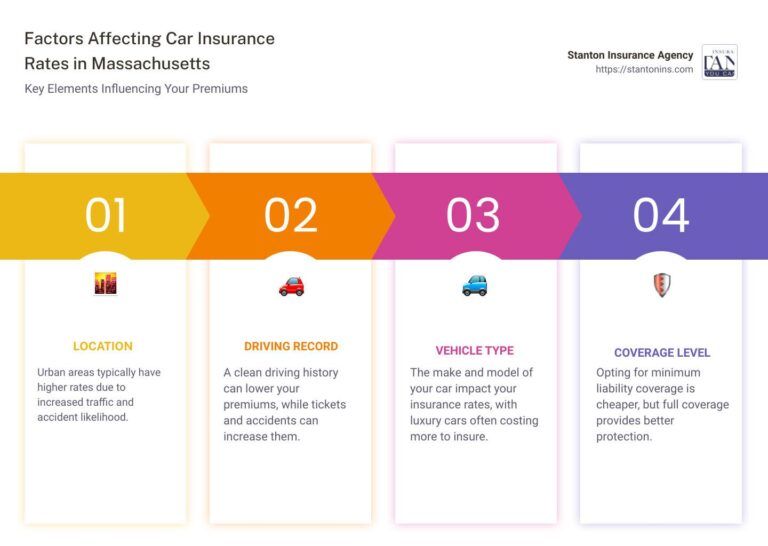

Massachusetts drivers are bracing for noticeable changes as the new minimum auto insurance liability coverage requirements take effect. Insurance companies are recalculating risks and premiums, which could lead to an increase in monthly payments for many policyholders. While some drivers may face higher costs,the enhanced coverage provides more comprehensive protection in the event of accidents,perhaps reducing out-of-pocket expenses for those affected by serious claims. Insurers have indicated that rates will vary based on individual driving records, vehicle type, and location within the state.

Key factors influencing the impact on drivers include:

- Stricter minimum liability limits aimed at aligning with rising medical and repair costs

- Possible adjustments in underwriting criteria to offset increased coverage mandates

- Encouragement for drivers to review and update their existing policies to avoid lapses

- Potential incentives for safe driving and bundling multiple insurance products

Ultimately, while some residents may see higher premiums, the trade-off is enhanced financial security and peace of mind on Massachusetts roads.

Expert Analysis on Coverage Adequacy and Risk Management

Insurance experts emphasize that the recent increase in Massachusetts’ minimum auto liability coverage marks a significant step toward better financial protection for drivers involved in accidents. Previously, many motorists faced insufficient coverage, resulting in out-of-pocket expenses that could be financially devastating.The updated requirements are designed to address the rising costs of medical care, vehicle repairs, and legal judgments, ensuring that policyholders are more adequately shielded from potential liabilities.

Risk management professionals advise drivers to consider going beyond the new minimums to truly safeguard their assets and future earning potential. Key recommendations include:

- Evaluating personal financial exposure to potential claims that exceed basic coverage limits.

- Consulting with insurance agents to tailor policies that reflect individual risk profiles and lifestyle factors.

- Reviewing coverage options such as uninsured motorist protection and comprehensive collision insurance.

By proactively optimizing their coverage, Massachusetts drivers can better navigate the evolving legal landscape and minimize financial vulnerabilities stemming from vehicle-related incidents.

Tips for Massachusetts Drivers to Navigate the New Insurance Landscape

With Massachusetts raising the minimum auto insurance liability limits, drivers need to approach policy selections with greater diligence.Experts advise reviewing current coverage levels and consulting with insurance agents to ensure alignment with the new mandates. This is particularly crucial for those with older policies that may no longer meet updated state requirements. Additionally,taking time to understand the financial impact and potential premium adjustments can help avoid unexpected costs or coverage gaps.

To effectively adapt, consider these strategies:

- Shop around: Compare quotes from multiple insurers to find competitive rates that fit your budget.

- Ask about discounts: Inquire if bundling auto with home or other insurance could lower premiums.

- Increase deductibles carefully: A higher deductible may reduce monthly costs but consider your ability to cover it in case of a claim.

- Regularly update your policy: Periodic reviews help maintain compliance and optimize protection based on your driving needs.

To Conclude

As Massachusetts raises the minimum auto insurance liability coverage,drivers across the state will need to reassess their policies to ensure compliance and adequate protection. While this change aims to enhance financial security on the roads, it may also influence insurance rates, prompting many to shop around for the best coverage at competitive prices. Staying informed about these developments and reviewing insurance options can definitely help Massachusetts drivers navigate the evolving landscape effectively. For more details on auto insurance requirements and available plans, consumers are encouraged to consult official resources and compare quotes from multiple providers [[3]](https://www.mass.gov/automobile-insurance).