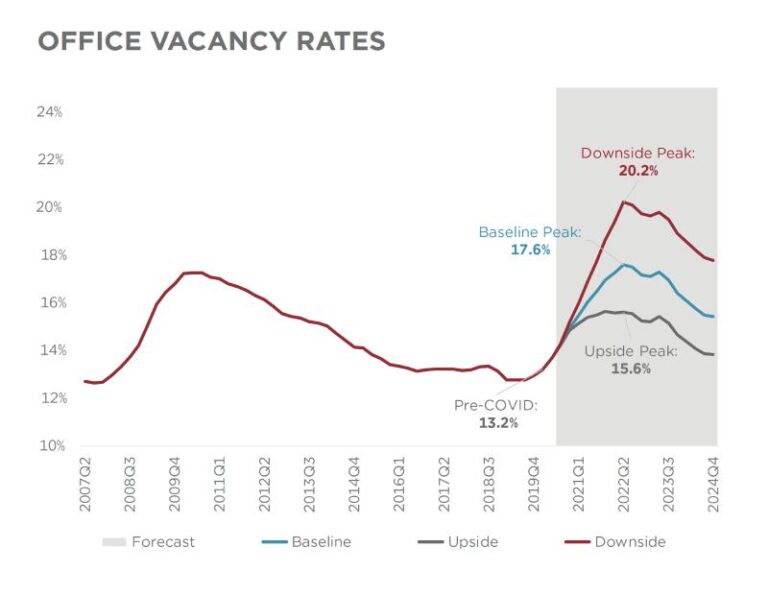

High office vacancy rates are reshaping the commercial real estate landscape, prompting landlords, investors, and developers to rethink traditional strategies. As more companies downsize or adopt hybrid work models, empty office spaces are becoming an increasing concern in major urban centers.This shift is accelerating changes in property usage, investment focus, and urban planning, signaling a pivotal transformation in how commercial real estate markets operate moving forward.

Table of Contents

- High Vacancy Rates Reshape Urban Office Markets

- Tenant Preferences Shift as Remote Work Endures

- Investment Strategies Adapt to Changing Demand

- Revitalization Initiatives Offer New Opportunities for Landlords

- The Conclusion

High Vacancy Rates Reshape Urban Office Markets

Urban office spaces are witnessing an unprecedented transformation as vacancy rates soar across major metropolitan areas. Once thriving business districts now face sprawling empty floors, forcing landlords and property managers to reconsider their strategies.This surge in unoccupied office real estate is largely driven by shifting workforce trends, including the rise of remote and hybrid work models, which have permanently altered demand. Consequently, landlords are resorting to creative measures such as offering flexible lease terms, incorporating co-working setups, and repurposing spaces to attract a broader range of tenants.

The ripple effects extend beyond leasing strategies, impacting urban economies and commercial real estate valuations. Investors and developers are recalibrating expectations as reduced foot traffic challenges ancillary businesses like cafes and retail outlets within these office hubs. Industry insiders highlight key market adaptations:

- Conversion of office buildings into mixed-use developments, including residential and cultural spaces

- Increased emphasis on sustainable and tech-integrated facilities to meet evolving tenant preferences

- Enhanced incentives to attract startups and smaller companies seeking affordable, short-term occupancy

Tenant Preferences Shift as Remote Work Endures

As remote work becomes a permanent fixture rather than a temporary adjustment, tenants are reevaluating their office space needs with a fresh outlook. The traditional demand for expansive, centralized offices has diminished, giving way to a preference for more flexible, hybrid workspace solutions. Companies now prioritize locations that support a balance between in-person collaboration and remote productivity, driving interest toward adaptable floor plans, co-working spaces, and technology-integrated environments.

Key shifts shaping tenant preferences include:

- Reduced overall square footage requirements coupled with an emphasis on high-quality communal spaces

- Greater demand for buildings equipped with advanced connectivity and wellness amenities

- Location flexibility, with increased focus on proximity to transit and suburban office hubs

This evolution means landlords and developers must innovate to remain competitive in a market characterized by high vacancy rates and evolving tenant expectations. Buildings that can offer adaptable leasing terms and modernized facilities are poised to attract tenants looking to future-proof their office investments.

Investment Strategies Adapt to Changing Demand

Investors are recalibrating portfolios in response to the surge in office vacancies,with a marked pivot away from traditional commercial real estate assets. The oversupply and diminished rental demand have cast doubt on the long-term profitability of conventional office spaces, prompting a shift toward more resilient and adaptive property types. Notably,investment flow is increasingly directed toward:

- Industrial and logistics facilities, fueled by e-commerce expansion

- Mixed-use developments that blend residential,retail,and office functions

- Adaptive reuse projects, transforming vacant offices into creative workspaces or residential units

This strategic reallocation reflects a broader recognition that agile,demand-responsive approaches must replace the once-prevailing office-centric models. Financial vehicles, including real estate investment trusts (REITs) and mutual funds, are increasingly incorporating these asset classes to balance risk and capture emerging trends.

Market participants are also embracing diversification, mitigating exposure by balancing real estate holdings with alternative investments such as bonds and ETFs. The evolution illustrates an enhanced focus on liquidity, flexibility, and income stability amid an unpredictable commercial property landscape.As investor appetite shifts,traditional benchmarks for value and yield in the commercial real estate sector continue to be rewritten,underscoring a fundamental transformation in how capital seeks returns in this new habitat.

Revitalization Initiatives Offer New Opportunities for Landlords

Amidst rising office vacancies, local governments and private developers are launching aggressive revitalization initiatives that promise to transform underutilized commercial spaces into vibrant hubs. These efforts include zoning adjustments to allow mixed-use developments, tax incentives for adaptive reuse projects, and partnerships aimed at modernizing infrastructure. Landlords stand to benefit from these programs as they can pivot from traditional office leasing to innovative uses such as co-working spaces, residential conversions, and experiential retail environments.

Key elements propelling this shift include:

- Flexible leasing terms that attract emerging industries and startups seeking shorter commitments and scalable spaces.

- Capital improvements funded through public-private partnerships, enhancing property appeal and energy efficiency.

- Community engagement initiatives that foster local support and drive organic foot traffic to revitalized districts.

These strategies not only help landlords mitigate the impact of prolonged vacancies but also position commercial properties for long-term sustainability in an evolving market.

The Conclusion

As high office vacancy rates continue to reshape the commercial real estate landscape, stakeholders are adapting to an evolving market that demands flexibility and innovation. The shift underscores a transformative period for urban workspaces, with long-term implications for investors, developers, and tenants alike. As this trend unfolds, close attention to market dynamics will be crucial for navigating the future of commercial real estate.