A new statewide bill aimed at banning broker fees for renters has been introduced, signaling a potential shift in the rental market’s financial landscape. Following the footsteps of New York City’s recently enacted FARE Act, which eliminates broker fees for tenants and transfers the cost to landlords, this legislation seeks to ease the financial burden placed on renters across the state. The bill comes amid ongoing debates about transparency and fairness in real estate practices,as advocates push for greater protections for renters navigating increasingly competitive markets. If passed, the bill could fundamentally change how rental agents are compensated and reshape the dynamics of renting statewide.

Table of Contents

- Statewide Bill Seeks to Eliminate Broker Fees Burdening Renters

- Impact of Broker Fee Ban on Rental Market Affordability and Accessibility

- Landlord and Broker Industry Responses to Proposed Legislation

- Policy Recommendations to Support Renters Amid Rising Housing Costs

- Closing Remarks

Statewide Bill Seeks to Eliminate Broker Fees Burdening Renters

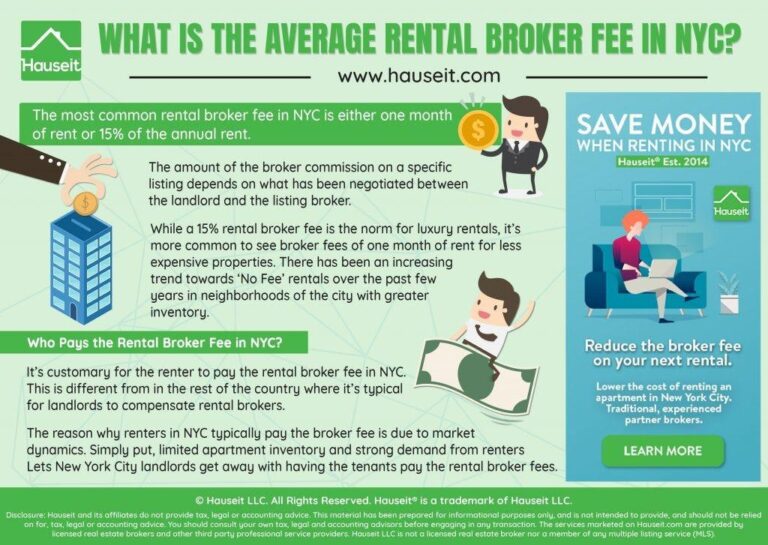

A new legislative proposal aims to relieve thousands of renters from the frequently enough unexpected and steep costs of broker fees associated with securing rental properties. The bill seeks to prohibit landlords and brokers from charging these fees, which can amount to a ample portion of first-month rent and create barriers for low- and middle-income tenants. Supporters argue that eliminating broker fees will promote fairer access to housing and reduce upfront financial strain, as renters currently face a system where fees are double-paid-both by tenants and landlords-despite the service primarily benefiting property owners.

Key provisions of the bill include:

- Complete ban on broker fees payable by renters;

- Requirement that landlords cover any brokerage costs;

- Penalties for violations to ensure enforcement;

- Exemptions only for cases with explicit renter consent.

If passed, this legislation would align with growing nationwide efforts to make housing markets more transparent and affordable, reflecting widespread tenant advocacy and economic equity concerns.

Impact of Broker Fee Ban on Rental Market Affordability and Accessibility

The proposed legislation to ban broker fees for renters is poised to reshape the rental landscape by directly addressing the financial burdens placed on tenants. Removing upfront broker fees, which frequently enough amount to several hundred dollars, will significantly enhance affordability for many prospective renters, particularly those from low- to moderate-income backgrounds. The elimination of these fees is expected to reduce the initial barriers to accessing housing, making it easier for a larger and more diverse population to enter the rental market without facing prohibitive costs.

Beyond affordability, the fee ban could also have profound effects on market accessibility. Without the incentive of high commissions, brokers may shift their operational focus, potentially leading to:

- Increased transparency in rental listings and processes.

- More direct landlord-to-renter interactions, streamlining negotiations.

- Greater competition among rental platforms, benefiting consumers through improved services.

This democratization of access may encourage a healthier rental market dynamic,reducing discriminatory practices sometimes fueled by broker-driven controls and costs. However, some industry experts caution that the transition could also impact broker revenues and the level of personalized service renters currently receive, signaling a significant shift in how rental markets function.

Landlord and Broker Industry Responses to Proposed Legislation

Landlord organizations have voiced strong opposition to the proposed statewide ban on broker fees, arguing that the legislation would shift financial burdens unfairly onto property owners. They contend that broker fees compensate for the administrative and marketing efforts required to lease units, which are critical in maintaining a stable rental market. Some landlords warn that eliminating these fees may lead to increased rent prices or reduced maintenance budgets as property owners seek option ways to offset the loss of revenue.

Simultaneously occurring, broker industry representatives express concern over potential impacts on their business models, emphasizing the value of their expertise in connecting renters with suitable housing. Brokers highlight that such fees fund essential services, such as tenant screening and negotiation facilitation. Opponents of the bill have proposed alternatives, including:

- Enhanced transparency mandates around broker fees to protect consumers without abolishing them

- Caps on fee amounts rather than outright bans to balance consumer protections with industry sustainability

- Incentives for landlords and brokers to reduce costs through innovative leasing solutions

Both industries continue to engage with lawmakers as the bill progresses, seeking a compromise that addresses renter concerns while preserving viable industry practices.

Policy Recommendations to Support Renters Amid Rising Housing Costs

As housing costs continue to climb, experts emphasize the necessity of comprehensive reforms to alleviate the financial burden on renters. Central to these reforms is the elimination of broker fees, which significantly inflate move-in costs and exacerbate affordability challenges. Advocates propose measures that include:

- Legislative bans on broker fees to ensure renters are not subject to hidden or excessive charges.

- Strengthening tenant protections around rental agreements, eviction processes, and deposit returns.

- Incentives for affordable housing progress to expand market options for low- and middle-income families.

Implementing these policies could provide immediate relief for renters while setting a foundation for long-term housing stability.Experts also call for increased transparency in the rental market,advising landlords and agencies to clearly disclose all fees upfront. Such steps would foster a fairer rental surroundings and diminish predatory practices that disproportionately affect vulnerable populations.

Closing Remarks

As this bill progresses through the legislative process, its potential to reshape rental markets statewide remains under close watch by tenants, landlords, and industry stakeholders alike.Advocates argue the fee ban could provide much-needed relief to renters facing soaring housing costs, while opponents caution about possible unintended consequences for the rental market. The coming months will reveal whether this proposal garners the support necessary to become law and how it might ultimately impact renters across the state.