The Massachusetts Bay Transportation Authority (MBTA) is undergoing a critical phase of financial recalibration as recent legislative actions and executive decisions aim to stabilize its budget and secure its future. With the Massachusetts Legislature allocating significant new investments totaling $716 million,funded by surplus revenue from the Fair Share surtax on high incomes,and Governor Maura Healey’s budget initiatives injecting $470 million to help close the MBTA’s budget gap,the transit agency’s long-term fiscal health is gradually improving. These measures address immediate deficits while enhancing capacity for essential capital projects,such as track repairs and new trains,positioning the MBTA for sustained operational stability amid growing regional transit demands. This article examines the current state of the MBTA’s finances, the efficacy of recent budget fixes, and the outlook for its long-term financial health in the coming years. [[1]](https://malegislature.gov/PressRoom/Detail?pressReleaseId=208) [[2]](https://mass.streetsblog.org/2025/01/29/by-the-numbers-how-governor-healeys-budget-fixes-the-mbta-deficit-for-a-little-while) [[3]](https://www.planetizen.com/news/2025/07/135480-massachusetts-budget-helps-close-mbta-budget-gap)

Table of Contents

- MBTA Revenue Streams and Spending Patterns Analyzing Operational Costs Against Capital Investments Strategic Challenges Facing MBTA Financial Planning Prioritizing Sustainability and Service Expansion in Budget Allocation

- In Retrospect

MBTA Revenue Streams and Spending Patterns Analyzing Operational Costs Against Capital Investments Strategic Challenges Facing MBTA Financial Planning Prioritizing Sustainability and Service Expansion in Budget Allocation

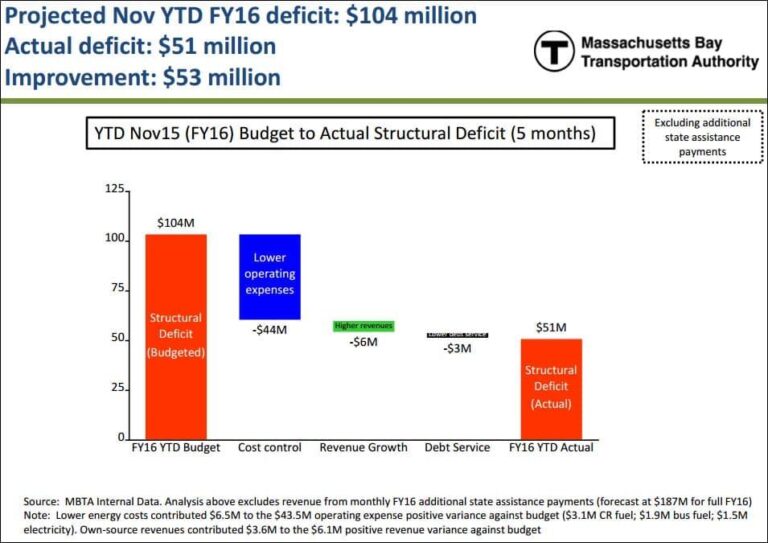

MBTA’s financial ecosystem is marked by a diverse mix of revenue streams including fare collections, federal and state funding, and ancillary income sources such as advertising and real estate leases. However, the delicate balance between operational costs and capital investment remains a constant challenge.Operational expenses, dominated by maintenance, personnel, and energy, frequently enough constrain available resources for vital infrastructure upgrades and technological enhancements. Meanwhile,capital investments are crucial for expanding capacity,modernizing aging systems,and improving overall reliability,yet securing sustainable long-term funding for these initiatives is increasingly difficult amid fluctuating economic conditions.

Strategic financial planning within the MBTA entails navigating complex trade-offs that directly impact service quality and environmental goals. Among the pressing challenges are:

- Aligning budget priorities to ensure both immediate operational efficiency and long-term resilience

- Integrating sustainability targets with ongoing expansion plans

- Balancing stakeholder demands for affordability against necessary fare and funding adjustments

In response, the MBTA is progressively prioritizing investments aimed at sustainable transit solutions and service expansion to accommodate growing ridership, while applying rigorous cost controls across all functions. This forward-looking approach is essential to fortifying financial health and meeting the evolving transportation needs of the region.

In Retrospect

As the MBTA navigates the complexities of funding and expenditure, its long-term financial health remains a crucial concern for riders, policymakers, and the wider community. Balancing immediate operational needs with strategic investments will be key to ensuring sustainable service and infrastructure improvements. Ongoing scrutiny and transparent budget management will play a vital role in shaping the future of Massachusetts’ public transit system, as it strives to meet growing demands and fiscal challenges ahead.