A national recession sends ripples across the entire country, influencing economic conditions far beyond its initial epicenter. For Massachusetts, an economically diverse state with key industries ranging from technology to healthcare, the effects of a broader downturn bring both challenges and uncertainties. As businesses brace for tightened consumer spending and potential job losses, analysts and policymakers alike are closely monitoring how national economic contraction will reshape the Bay State’s financial landscape. This article explores the multifaceted impact of a national recession on Massachusetts’ economy, examining sectors most vulnerable to slowdown and strategies underway to mitigate the fallout.

Table of Contents

- Economic Downturn Strains Key Industries in Massachusetts

- Rising Unemployment Trends and Workforce Challenges Ahead

- Housing Market Volatility and Consumer Spending Patterns

- Policy Measures and Strategic Recommendations for Economic Recovery

- Wrapping Up

Economic Downturn Strains Key Industries in Massachusetts

The recent national recession has sharply tested the resilience of Massachusetts’ economic foundations. Industries such as technology, manufacturing, and healthcare-traditionally pillars of the state’s financial health-are facing unprecedented challenges. Reduced consumer spending, disrupted supply chains, and declining investments have forced companies to adopt stringent cost-cutting measures, including layoffs and halting expansion plans. These developments have sent ripple effects through local economies,with smaller businesses feeling the strain from decreased demand and tighter credit conditions.

Experts highlight several sectors particularly vulnerable to the current downturn:

- Manufacturing: Factory output has slowed due to supply shortages and diminished orders, jeopardizing jobs and growth.

- Technology: As venture capital funding tightens, startups and even established firms are reevaluating project priorities and hiring freezes.

- Healthcare: Despite ongoing demand, elective procedures and outpatient services have dropped, impacting revenue.

Policy makers and business leaders are urgently seeking innovative strategies to mitigate these impacts and spur recovery, focusing on strengthening local supply chains and investing in workforce development to adapt to the evolving economic landscape.

Rising Unemployment Trends and Workforce Challenges Ahead

Recent economic slowdowns nationwide signal a potential surge in unemployment rates that could ripple across Massachusetts’ workforce landscape. With many sectors bracing for downturns, the state’s labor market faces mounting pressure as layoffs intensify and hiring freezes become common.Key industries that have traditionally served as economic anchors-including manufacturing, retail, and healthcare-are confronting uncertainties that threaten job stability and wage growth. This evolving scenario challenges policymakers and employers alike to maintain economic resilience amid shrinking job opportunities and growing unemployment concerns.

Addressing these challenges demands a multifaceted approach focused on workforce adaptation and skill redevelopment.Experts warn that without proactive intervention, rising unemployment could exacerbate socioeconomic disparities and stifle recovery efforts. Essential strategies include:

- Investment in retraining programs to equip displaced workers with skills relevant to emerging industries.

- Support for small businesses and startups as engines of job creation during economic contractions.

- Enhancing unemployment benefits and job placement services to mitigate immediate financial hardship for affected workers.

The convergence of these measures will be crucial for Massachusetts to navigate the rocky path ahead, ensuring the workforce is prepared to meet tomorrow’s economic demands.

Housing Market Volatility and Consumer Spending Patterns

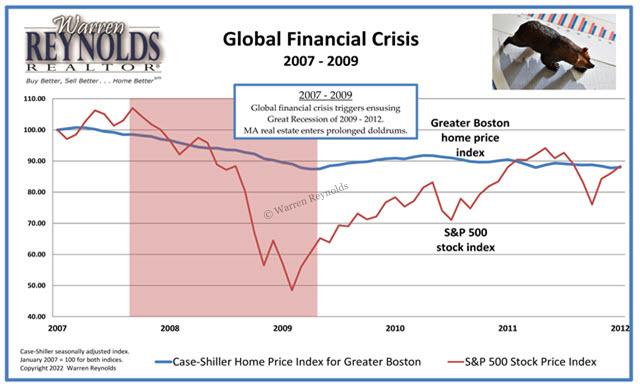

Economic uncertainty stemming from a national recession has shackled the housing market, resulting in a prolonged period of stagnation that experts predict may last until at least 2026.This inertia in home prices and sales casts a long shadow over Massachusetts, a state where real estate significantly influences overall consumer confidence and spending behavior. As the housing sector remains frozen, potential buyers exhibit caution, holding back on large expenditures due to fears of depreciation and tighter mortgage financing conditions. Meanwhile, homeowners are less inclined to sell, further tightening housing supply and amplifying market volatility.

Consumer spending patterns respond dynamically to this housing market volatility, with noticeable shifts including:

- Reduced discretionary spending as households prioritize mortgage payments and essential expenses.

- Delayed home advancement projects, curtailing demand in construction and retail sectors linked to housing.

- Increased rental market activity, prompting higher rental costs but also a cautious outlook among renters approaching homeownership.

These factors collectively shape a cautious economic surroundings within Massachusetts, where consumer behavior clings closely to housing market signals, magnifying the recession’s overall impact on the state’s economic stability.

Policy Measures and Strategic Recommendations for Economic Recovery

In response to the economic downturn,policymakers should prioritize targeted fiscal stimulus directed at critical sectors within Massachusetts,such as technology,healthcare,and manufacturing. This approach includes increasing public investment in infrastructure projects to both create jobs and modernize essential services, alongside enhanced support for small businesses through grants and low-interest loans. Strengthening the state’s safety nets, including expanded unemployment benefits and workforce retraining programs, will be crucial in mitigating the recession’s human impact. A cooperative alignment between state authorities and the private sector will also enable more agile responses to emerging economic challenges.

Strategic recommendations emphasize fostering enduring growth by leveraging Massachusetts’ strengths in innovation and green technology. Policymakers should advocate for:

- Incentives for clean energy investments that promote long-term environmental and economic resilience

- Regulatory reforms easing barriers for startups and accelerating digital conversion across industries

- Enhanced collaboration between educational institutions and businesses to close workforce skill gaps

By implementing these measures, Massachusetts can not only cushion the immediate recessionary impact but also position itself for a robust, inclusive recovery that aligns with broader national and global economic trends.

Wrapping Up

As Massachusetts navigates the challenges of a national recession, the state’s economic resilience and strategic responses will be critical in shaping its recovery trajectory. While the downturn poses significant hurdles, careful policy decisions and local innovation may help mitigate impacts and foster renewed growth. As the national economy fluctuates, stakeholders in Massachusetts will closely monitor developments, balancing immediate concerns with long-term economic stability.